Product design, manufacturing and production systems, and supply chain integration are all examples of “technical” cultures that remain relatively “siloed” and autonomous. They add up to a huge collection of information-islands—whether on IT servers, your network service provider’s servers, in an embedded control system’s servers, or anywhere else. Assuming the islands remain in existence reliably, they are still fundamentally incapable of truly interoperating with other information-islands.

New technologies are reshaping how manufacturing businesses engage with customers and compete. It starts with the proliferation of both mobile “human-connected” devices and machine-connected IoT devices, which allow us to gather exponentially more data. Distributed information architectures enable far more efficient and fluid fusion of data which, in turn, enables us to capture, model and analyze information through local and cloud computational resources. As a result, AI tools become more potent in their ability to capture insights that complement and transcend the limits of human intelligence. The pace and scale of this virtuous cycle is accelerating. Over the next decade, these technologies will propel innovations that will change the ways we design, work, produce and learn.

The next cycle of technology innovation and systems development in the smart connected systems arena is supposed to be setting the stage for a multi-year wave of growth in the industrial and manufacturing arenas based on the convergence of these innovations. But is it?

Today’s key enabling information, networking, and automation technologies are still adopted and applied in the industrial sector in utterly distinct and unique ways. Product design, manufacturing and production systems, supply chain integration are all examples where the “technical” cultures applying them are relatively “siloed” and autonomous. All of this adds up to a huge collection of information-islands whether on IT servers, your network service provider’s servers or in an embedded control system’s servers or anywhere else. Assuming the islands remain in existence reliably, they are still fundamentally incapable of truly interoperating with other information-islands.

INDUSTRIAL USER AND ADOPTER CHALLENGES

Traditional industrial operations and maintenance practices are constantly challenged due to the complexity of the equipment, people and systems to operate and manage them. All of this is exacerbated by the relentless drive to reduce costs and increase the productivity of fixed assets. Industrial players cannot expect to compete effectively in the marketplace without aggressive investments in operations improvements and efficiencies, particularly those investments that leverage new data and decision support tools to improve asset tracking, visibility and the optimization of production systems.

The continuing push to lower production cost and increase product quality, flexibility and service levels has become the driving force. Any plant not lean enough and not flexible enough to deal with this reality faces the prospect of eroding market share. With growing complexity in the design of new products, plants and upgrade programs for existing operations, the key factors are process precision and flexibility, which dictate the reliability of the actual process and ultimately its quality. More importantly, the current practice of reactive and trial-by-error maintenance rather than a predictive maintenance is costing valuable uptime and hurting manufacturers’ ability to deliver quality products predictably.

Sadly, the IT systems that run most operations today were in all likelihood designed and implemented in much the same way as twenty to thirty years ago. Further, industrial concerns have followed the path of all enterprises, going off to implement ERP, asset management systems and other enterprise-oriented offerings. This accomplishes the management of complex business functions such as order entry, inventory management, sales and finances. These expensive enterprise systems all have a common limitation: while precise in their collection of data about when particular components were purchased and for how much, these systems take nothing into account with regard to the behavior or performance of the process producing them. Another way of stating this is that the ERP systems stop at inventory level, which is not actually a technical level. That the technical condition of a component or the state of production equipment could have an effect on the overall profitability of the plant is something the ERP system in its present state has no way of knowing.

By elevating these critical problems up from the “wrench-turners” to progressively higher levels of management, a more comprehensive production, operations and maintenance strategy can be attained, with critical, real-time information on the performance of machines and process dynamics. However, senior leadership in today’s environment typically do not get intimately involved with the daily operations and the particulars of servicing equipment and machines. Executives in today’s industrial arena do not yet see operations as fertile grounds for innovation to enable increasing shareholder value.

Historically, there has been a significant knowledge gap between those who are responsible for the financial performance of the organization and those responsible for product and process quality. This gap is caused by incompatible performance measures, poor communications between operating and management functions and rigid and brittle IT systems. In most cases, this leads to an environment where cost cutting is the only practiced resolution. Ultimately, this situation will drive measurable decreases in margins and performance.

The industrial arena as a whole has not found a way to reconcile the needs of general and financial management, who are responsible for overall profit and value creation, with those of the managers and systems used in daily operations. Even in the same organization, we find that people in different functions and departments and with different responsibilities that do not speak the same language. Integrating data and information values across product development functions, IT functions, manufacturing and production staff is where the issues and challenges lie. Those working in projects and programs use the jargon of their job functions which deters the ability to discover new integration value.

The goal of asset optimization is near-zero downtime for manufacturing operations equipment and processes based on the ability to model optimum machine performance and monitor real-world performance degradation using sensor data already available (but underutilized) on most state-of-the-art equipment. This requires the development of software systems to share this information over networks and the use of networked devices to leverage diverse information sources across the enterprise. Ultimately it means the creation of machines that learn, self-optimize, and even repair themselves—converting emergency repair visits into routine service.

When smart machines are networked and remotely monitored, and when their data is modeled and continually analyzed with sophisticated systems, it is possible to go beyond mere “predictive maintenance” to machine “prognostics”, the process of pinpointing exactly which components of a machine are likely to fail and when. When the “health” of machinery is almost perfectly visible, a business can plan intelligently rather than being blindsided by failure. When you know that a machine is about to fail, another machine’s output can be adjusted automatically to compensate for it, or the delivery of raw goods to the failing machine can be diverted to more productive equipment. Whatever the case, knowledge becomes the power to optimize processes, save significant amounts of money and achieve across-the-board business operations automation.

Today, many managers feel that they do not have enough data, the right data or reliable data to make accurate business decisions. Even information that seems common, such as accurate profit and cost information, often proves to be elusive. Some reasons for this are siloed and inaccessible storage processes for data, unclear understanding of how to extract value from data and the absence of data that is not being collected. This has often prevented industrial firms from successfully leveraging the data flowing from their equipment and operations.

Senior leadership, on the whole, has a very diverse and uneven understanding of value of data from these systems. Executives in today’s industrial arena are just beginning to see that data and analytics can unlock significant new shareholder value.

As a result, the industrial segment has invested substantially more in direct process systems and equipment than it has in extracting and leveraging information from operations. Investment in network technologies for mobile and distributed monitoring, for low-cost data extraction and for device and system connectivity continues to expand. However, digital technologies mean new opportunities for industrial players to utilize new data sources and values to re-design business and operations processes to strengthen themselves. Manufacturers are in a position to use data and analytics to enable critically important new improvements.

All too often, industrial customers are overly prudent adopters, driven by implementation costs, risk management and ROI, far more than new modes of innovation. but the benefits of digital and IoT technologies IP have become very clear. This, combined with an increasing recognition of open standards, has accelerated the pace of adoption.

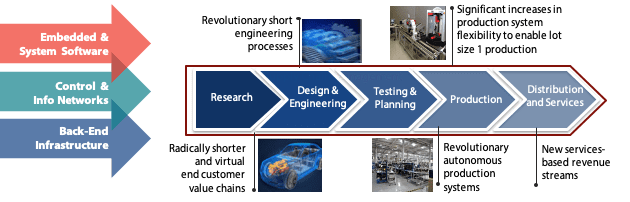

Manufacturers and thought leaders alike now see that digital manufacturing technologies will transform function in the manufacturing value chain, from research and development and marketing to scheduling, supply chain and factory operations, but in a very uneven manner. We see the increasing awareness of these new approaches, particularly in highly mission critical, but fast changing segments, but we also see adoption is driven more by specific companies and less by whole segments. There are, however, other factors contributing to uneven adoption of new converged technologies and many of them originate from the suppliers of automation, control and information systems.

INDUSTRIAL SYSTEMS SUPPLIER CHAOS

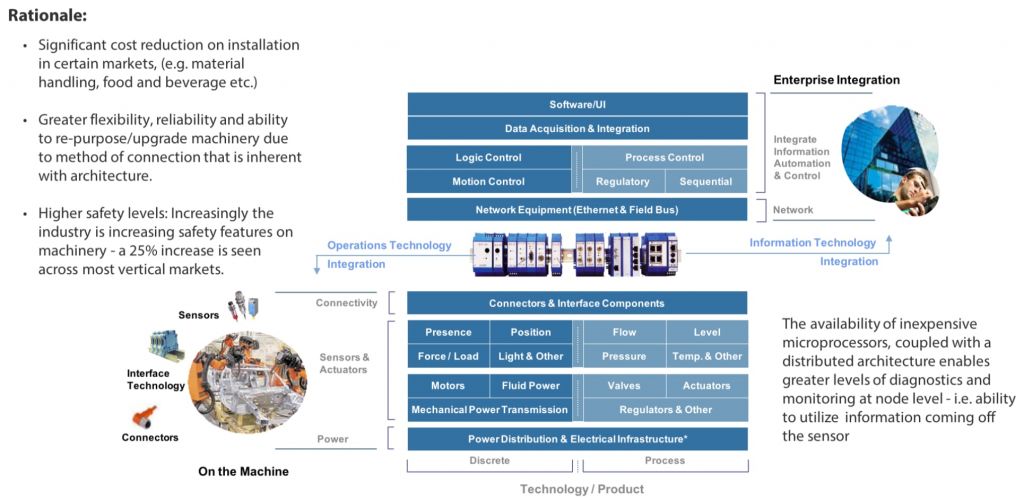

These days the industrial world is all too often segmented into two main groups: Information Technology (IT) and Operational Technology (OT) providers. While this segregation represents an important “boundary” that does describe two worlds that are very isolated from each other where players and systems are aligned, we think it’s too simple and trivializes the more complex underlying environment and its diverse behaviors.

IT systems are generalized and applicable across verticals. They encompass the spectrum of corporate systems, including finance, HR, supply chain, order management, and sales. These functions and their processes tend to have commonality across multiple industries, but within industrial there are also specialist IT players, such as Manufacturing Execution Systems (MES) and Computer Aided Design (CAD) systems, that model and supervise processes occurring on the plant floor.

OT systems tend to be task-specific and highly customized for industries. They cover a variety of systems running the creation of products, including the physical machinery in the plant, as well as the networking and command systems that control production. The former includes everything from presses and stamping machines to individual products like PLCs and servo drives. OT systems are considered mission critical. Since they are built for reliability, this design aspect often trumps other concerns, such as innovation, open architectures, and interoperability.

The emergence of new mobile, wireless, and open-platform technologies will be very disruptive to existing competitive structures and adoption practices. Industrial technology innovations cut horizontally across traditional product segments. IT players and new specialists will have a growing impact as new sensor intelligence and data extend capabilities and as new software and collaboration technologies enable robust service offerings. As the Industrial Internet of Things expands in the manufacturing world, the lines between OT and IT will blur. Traditional services and software providers and new digital and IIoT companies will continue to overlap in capabilities.

The traditional IT and ERP software players who have large installed user bases can leverage this position as an “anchor” in their drive to expand their application scope and reach. These mega-vendors have expanded their footprints by creating end-to-end portfolios for order management, for supply chain activities, and for design, sourcing, manufacturing, logistics, sales and marketing, and service management. Specialists in areas such CAD and PDM as well as SCADA are also leveraging their positions to expand offerings. In contrast, traditional OT vendors, coming from legacy market positions built around distributed control systems (DCS) or programmable logic controllers (PLC) as “anchor” platforms, are also trying to leverage and consolidate their traditional strongholds.

Some very large and prominent industrial players have made multiple forays into ”platform’s and ”industrial IT territory” (Asset Management, PLM, etc.), but they have mostly failed to embrace new software business models. Nevertheless many, if not most, existing players and solutions are still isolated in their traditional value scopes and their ability to understand and leverage integration opportunities across adjacent applications and new technologies. Thus, their ability to organically migrate and expand capabilities has been inhibited, preventing them from providing customers with more broad and converged capabilities. Convergence is much more likely to come through acquisition and vendor consolidation, creating a steady rise in competitive maneuvers as the larger diversified industrial players start to buy and instead of organically build new technologies into their portfolios.

In the end, the industrial arena suffers from a wide range of players who are confused about their changing roles – be that the likes of a GE or Bosch but also the Microsofts and the Oracles. ◆

Please fill out the form below to download our Market Insight “Industrial Smart Systems & IIoT Market Opportunities.”