After several years of hype about big data and analytics, it’s amazing how misunderstood and underestimated data management and analytics tools continue to be. In the Internet of Things and Smart Systems markets, the aggregation, transformation, analysis, modeling and management of data from sensors, machines and equipment are fundamental core enablers of machine learning—and thus the holy grail of IoT.

THE HERITAGE OF SMART SYSTEMS

For all their sophistication, many of today’s IoT systems are direct descendants of traditional “remote monitoring systems” where each device acts in a “hub and spoke” mode. Individual spokes don’t speak directly to their “peers”; everything goes through the hub. This heritage leaves many of today’s evolving data management tools unable to interoperate and perform well with distributed heterogeneous machine and sensor environments.

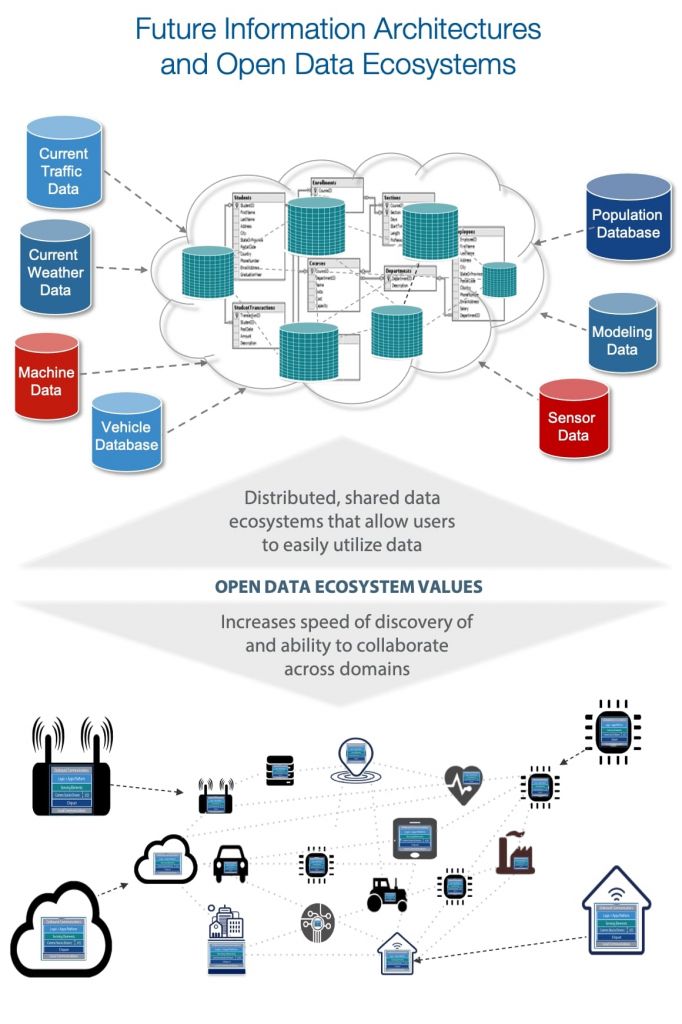

What’s required instead is a shift from the simple device monitoring to a model where device data is aggregated into a shared environment. The many “nodes” of a network may not be very “smart” in themselves, but when they are networked to connect and share data, they begin to give rise to complex, system-wide behavior, and the Smart Systems world needs to benefit from this new order of intelligence.

Source: Harbor Research, Inc.

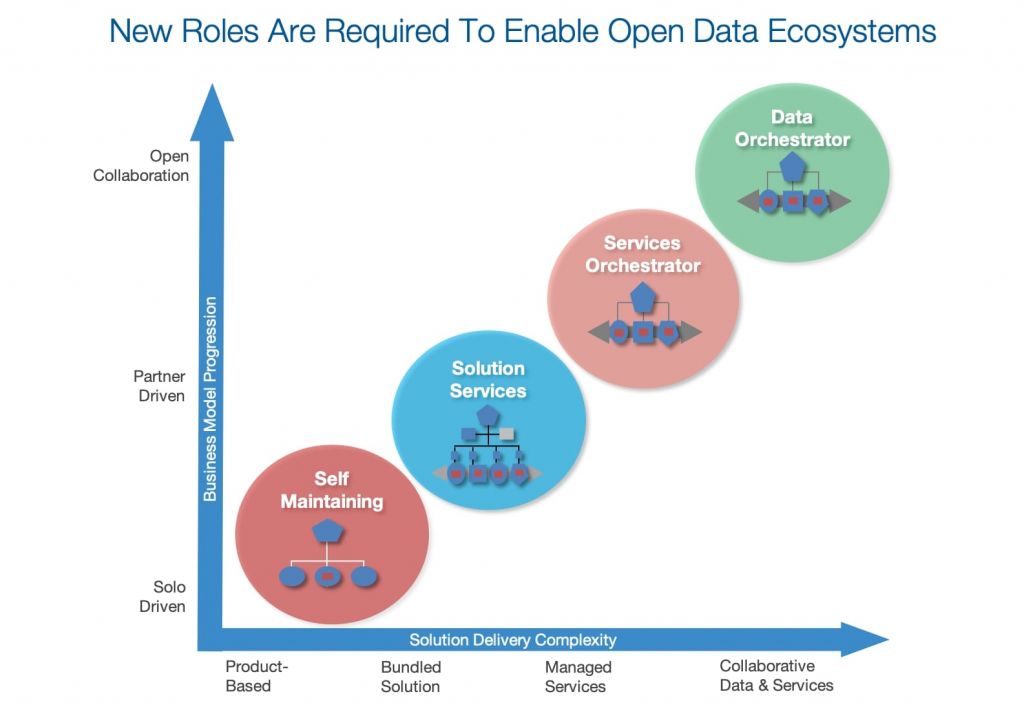

Users and providers of today’s custom-configured IoT and Smart Systems solutions—which are designed to address specific applications and use cases, including asset tracking, equipment monitoring and predictive maintenance—will increasingly be pressured to migrate these focused solutions across as many platforms, marketplaces and ecosystems as possible. In order to remain competitive, system providers will need to evolve toward business models that address a larger and more impactful scope of value. Getting to this future state requires that players act more as orchestrators of data and data services in an expanded ecosystem of peer contributors and participants.

THE EMERGENCE OF DATA ECOSYSTEMS

Data ecosystems organized by players such as Amazon, Google, Facebook and Netflix have demonstrated that they can create enormous value for B2C businesses. Google, Facebook, Amazon and similar peers have a unified usage and data relationship with their respective users—so much so that they don’t require additional data sources to create value within their business models. Mobile phone data-feeds come from virtually everyone today and provide consumer Internet players with just about everything they would ever want to know about the user.

B2B alliance and ecosystem development for smart systems today looks nothing like the mobile and consumer Internet worlds. Why? The mobile phone business spent years looking for its killer application and, as things turned out, the killer application ended up being the ecosystem of application developers, exemplified by the rapid growth of the iOS and Android platforms.

Data and apps are the core value creation mechanisms within the Smart Systems and the IoT.

But the B2B world that comprises so much of the IoT doesn’t have the same unified sources or monolithic usage tracking and analytics that the consumer world utilizes to make money. Reliable sources estimate that they lack half the data needed to inform new application values and fulfill on artificial intelligence and machine learning opportunities. How should B2B players think about creating equivalent value with data?

Given the environment they’re in, we at Harbor have long maintained that B2B players should create data ecosystems.

However, ecosystem development in B2B domains has been much slower in its evolution than in the consumer world. Product OEMs and machine builders work with software developers and solution players in a much more “command and control” mode and have largely forged only simple relationships with wireless carriers, enterprise applications or professional services providers.

Source: Harbor Research, Inc.

WHERE ARE THE BIGGEST B2B DATA OPPORTUNITIES WHO IS LIKLIEST TO WIN?

Adoption of Smart Systems and IoT opportunities in general and, more specifically, of data-driven and analytics opportunities will vary by industry with the pace determined by the level of mission and business criticality overall. We believe the vertical industries and applications with the highest potential for data analytics and applications growth will demonstrate some combination of the following characteristics:

- Process technology is complex, heterogeneous and interrelated, with many types of varied equipment and systems;

- The capital cost of the equipment, as well as the economic impact of the equipment and systems “in-use,” is high (and corresponding cost of downtime is high)

- Buying behavior in target accounts is sophisticated and users tend to have higher skill levels (often invest early in new capabilities such as predictive maintenance)

- Target accounts show a propensity toward adopting new technologies earlier than peer industries with similar characteristics

- There is a “mixed” maintenance and support environment that drives frequent interactions between and among first level in-house maintenance staff and OEM equipment service staff, as well as third party services, including traditional out-sourced maintenance and specialty services (e.g. vibration analysis services, etc.);

Even though segments with the characteristics described above tend towards more sensor use, instrumenting and automation, customers in these segments suffer the same challenges that many B2B businesses face. Existing systems, including CMMS/asset management, condition monitoring, remote equipment services, reliability services and related automation and control technologies, are not fully integrated and the information they accumulate cannot be easily accessed across differing vendors systems.

While there have been a multitude of new tech-driven entrants into most segments where Smart Systems and IoT data opportunities are in abundance, existing machine, equipment and device OEMs have just as aggressively moved into expanded solutions that address new application and use case opportunities that are enabled by data insights. There are numerous examples of B2B equipment OEMs providing software, IoT and Smart Systems solutions in mining, agricultural, energy, manufacturing, vehicles, healthcare technology and more.

There’s a new competitive race that has started between IoT start-ups, digital natives and established equipment solutions businesses across the B2B landscape. Do the above-described characteristics that outline very large data opportunities favor the new entrants or the established equipment players?

We tend to think the defining attributes favor the equipment OEMs. There are more apparent structural advantages that accrue to the OEMs including:

- The existing in-depth relationships OEMs have with their end customers that fosters a deeper understanding of the domain and customer operations

- OEMs are providing solutions that have a very direct involvement in the customer’s mission critical operations

- Many OEMs already have direct access to large amounts of data generated by their equipment and adjacent systems

- OEMs have an understanding and ability to utilize data and analytics to have very direct impacts on optimizing the customer’s operations

So how can OEMs win with their “inherited” positions in so many industries and applications?

Source: Harbor Research, Inc.

AN ECOSYSTEM OF DATA

As B2C and B2B networked business models inch closer to each other in the marketplace, it is increasingly evident that the consumer Internet models provide many lessons for the “cloistered” B2B players. The benefits of large-scale collaboration, ecosystems and developer communities in the B2B dimension of the Internet of Things arena are just beginning to be recognized.

What can the Internet of Things learn from this? What would B2B data ecosystems for the Internet of Things look like and what potential could they inform? How should innovative players, large or small, engage in new collaborative data relationships to drive market development? Are there fundamental barriers that need to be overcome? What maneuvers can players execute to address them?

Data will never come from a single unified source. What technology players looking to leverage data collaboration—or benefit from connecting diverse “smart products” to the Internet—need to understand is that we have entered a phase in the marketplace where data with real practical value can originate from just about anywhere. It simply needs to be better organized, facilitated and orchestrated.

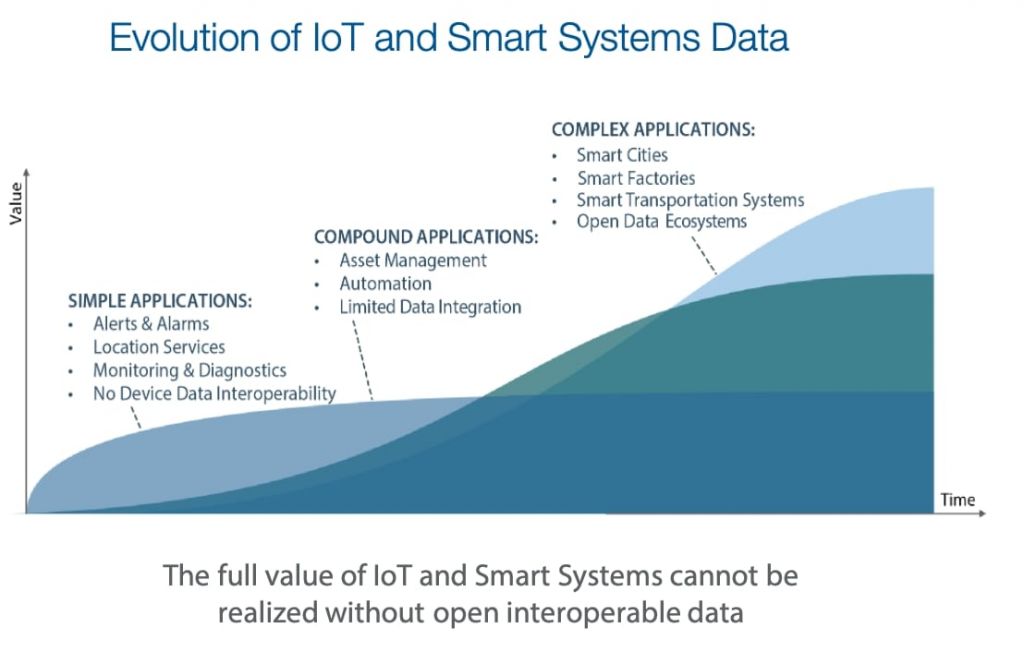

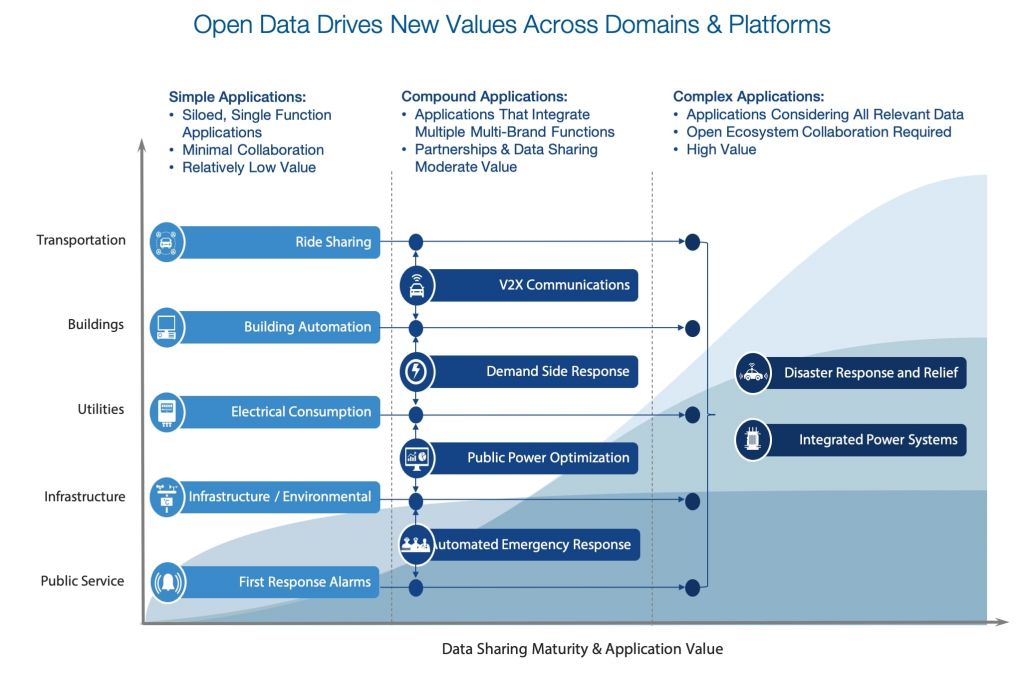

The collection of dull and dreary “solo” solutions—like equipment automation, meter reading, and fleet tracking applications—that comprise a significant percentage of the IoT world today are really simple applications focused on remote diagnostics or tracking/location services. This is largely because of technical complexities and business model challenges. These simple applications don’t really need to be “open for data sharing.”

Moving from such “simple” applications to “compound” applications—for example, monitoring and acting on all the services in a factory or a skyscraper—involves multiple collaborating systems with significant interactions between and among devices, systems, people and vendors. No longer is the focus solely on the product supplier’s ability to deliver support for their product efficiently. Rather, value is brought to the customer through new process-automation and systems optimization. However, open data sharing between and among B2B OEMs would best be described as a mythic future state. These players still push proprietary systems to their users in hopes of gaining monolithic account control.

Between the complexities of “compound” applications and the culture and behavior of B2B OEMs, it is difficult to imagine freely open and fluid data ecosystems. However, the need to combine and integrate diverse data and data sources will soon become the very air that business breathes. Product OEMs that do not find ways to participate in newly emergent ecosystems and to share data with partners and alliances will simply not survive. But how do businesses who become more connected, open and willing to share data change their underlying concepts of “ownership” and yet remain distinct and profitable?

WHAT THE FUTURE OF DATA REQUIRES

So how will machine and equipment OEMs “inherit” and win the machine data opportunity and

what’s really required to drive the data aggregation, sharing, and innovation that would inform new collaborative business models for Smart Systems? At Harbor we recommend changing the risk/reward formulas for data alliances and new relationships in the Internet of Things.

This involves three interrelated elements:

- A vision for how data collaboration networks will drive “catalytic” innovation to help focus participants

- An architecture to organize value creation with data which provides leverage to reduce the investment and effort participants need to get access and provides tools and easier ways to fuse and use data

- Relationship enablers and economic incentives which persuade participants that the ecosystem developer is serious and can really scale entirely new value creation via data sharing and new services delivery systems

If we accomplish these things, then in most complex domains—smart cities, smart agriculture, smart grid, connected transportation, etc.—we will have the capabilities for a productive future. For example:

- Agricultural companies will be able to develop new services to help farmers predict and optimize crop yields that could fuse weather models, forecasts, and real time weather conditions with geolocation data and equipment and IoT data

- Logistics companies will use external data to predict disruptions in their retail customers’ supply chains based on locations, inventories, social media, data from suppliers and more

- Smart-city emergency response services will get to accidents or disaster sites and on to hospitals as quickly as possible leveraging imaging data, maps, traffic flow data and much more

Even though no one can predict precisely when new innovations mature, the process by which they will be delivered is now clear. Leveraging data and software innovations is creating the potential for visionary OEMs to step into the important role of “data orchestrator”—that is, to become the facilitators of the orchestration process. Data orchestrators who facilitate and leverage digital platforms and shared data will enable new alliances based upon co-creation, and these partnerships will become increasingly important from a B2B perspective. ◆

This essay is supported by our Technology Insight “Open Data Ecosystems for Smart Systems.”

Fill out the form below to download the Insight for free.