To date, most of the successful platform businesses are “consumer” or “user” focused. Fewer B2B markets have embraced this type of business model. We predict this will soon change. Freight logistics, genetic sequencing, order management, and asset management are examples of new beachheads for platform models in the B2B sector.

A VAST, UNIFIED INDUSTRIAL-TECHNOLOGY SECTOR

If we reanimated a cryogenically frozen person from 1999, the most surprising thing about the world of 2019 might be what has happened to manufactured things. A realm of tiny, low-cost digital components and communications interfaces has made virtually every physical product part of a vast, unified industrial-technology sector. Competitive advantages resulting from previous generations of technology dominance—such as chemical-based imaging/film or electro-mechanical systems for control—have, in a mere twenty years, completely disappeared.

The strategic implications of this trend go far beyond the replacement of one set of components or suppliers by another. All industries are now subject to the cost structures and technology directions common to digital components and products. In fact, all the rules of the strategy and business-model game have radically changed in a time-frame so brief that corporate leadership often can’t keep up.

The technical innovation driven by digital and IoT technologies, coupled with diverse and changing relationships between and among complementary players, will likely lead to changes in market structure, shifts in the sources of profit and value creation, and thus new business and operating models. Identifying and designing new business models along with developing the new skills, capabilities, systems and organizational relationships they require will be critical to success.

THE RAPID RISE OF PLATFORM COMPANIES

The influence and disruptiveness of so-called “platform” companies affect much of the business world these days. Platform business models are popping up everywhere—in human resource management, order management, toys, customer relationship management software, consumer lending, digital advertising, payments, fashion, car rides, asset management, publishing and more.

Consider the scale and impact of technology-enabled platform models like Google, Apple, Uber, Airbnb, and their ilk. These businesses creatively combine elements of dis-intermediation, new recurring services, new relationships, profit pool migration, customer transparency, and other maneuvers to disrupt existing operating models.

Whether driven by the scale of users (Facebook’s immense user base enabled by social relationships and interactions), or enabled by technical standards (Cisco’s network operating system, or Microsoft’s Windows or Azure today), these new models are changing business forever.

To date, most of the successful platform businesses are “consumer” or “user” focused. Fewer B2B markets have embraced this type of business model. We predict that this will soon change. Freight logistics, genetic sequencing, order management, and asset management are examples of new beachheads for platform models in the B2B sector.

EMERGING B2B PLATFORM MODELS

Massive outsourcing of corporate services, combined with the emergence of platform business models is causing the “dis-integration” of traditional enterprises and is restructuring businesses into three broad categories or roles: 1) platform players, 2) horizontally focused providers of outsourced “professional services” and, 3) vertically focused “specialist” product and service businesses.

The growing influence and disruptiveness of platform models is forcing all businesses to think more carefully about their future roles. Since not all businesses can be platform players, organizations are now focused on which role suits them, and which players (in the other two categories) are prospects for win-win partnerships that will maximize value for customers.

As businesses come to understand that future enterprises will all be part of new ecosystems and value-delivery networks, they are recognizing the era of “going it alone” or “flying solo” is over. The “command-and-control” alliance and partnering strategies of the past will not be effective in the complex, instantaneous, interwoven global digital economy.

Both platforms and outsourcing will require huge scale, but small product and service companies will be able to use that scale to thrive as well. “Everything as a service” will be available on demand, from a mix of horizontal (cross-industry) and vertical (industry-specific) outsourcers, with the latter often set up as joint ventures by industry participants. There will be ongoing battles at the intersections of these three types of companies.

RIPE FOR A DECENTRALIZED REVOLUTION

But this revolution will not be limited to consumers and web services. Two of the economy’s largest subsectors, energy generation/transmission and food production/distribution, are ripe for a decentralized revolution. Around the world, products and services are beginning to emerge and make their way to market, with much of the infrastructure now in place for these aspirational disruptors to grow exponentially over the next decade or so.

Next generation platforms will become a material force for building community and increasing bargaining power among skilled workers, much as unions have done historically for lower-skilled workers.

We believe new digital and Smart Systems technologies will turn-long held beliefs upside down, and we expect an out sized impact on traditional OEM strategy. For example, many managers believe that you can be big and low cost, or you can be focused and differentiated—but not both. Today’s Smart Systems and IoT technologies are enabling new modes of services delivery and creating new opportunities with data and analytics capabilities that will significantly reduce, if not eliminate, this classic strategic trade-off. This, we believe, is but one example of the extraordinary effects new systems technology will have on OEMs.

TECHNOLOGY AND BUSINESS ARCHITECTURES BECOME ONE

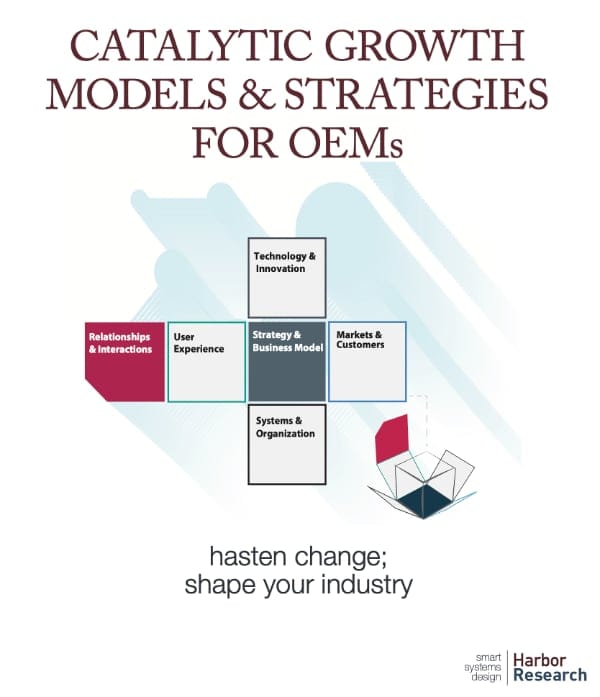

Perhaps the most important perspective we have come to as a result of this “platform” phenomena concerns 1) the relationship between technology architectures and business models, and 2) the “role” that platforms and relationships will play in enabling a whole new level of differentiation. Platform development decisions must be aligned with the corresponding business and revenue models.

These two “architectures”—technology and business—need to be mutually supportive without inhibiting one or the other. Our evolving thesis is that we will see an ever-tighter coupling of them, and that success will increasingly go to those that effectively utilize the combined potential of both. In turn, the emerging platform will become the central organizing mechanism for delivering new data and information-driven services.

However, coordinating and leveraging technology architecture and business architecture has never been in the wheelhouse of traditional OEMs, and it often creates contention. Management attention in OEM businesses has traditionally focused on the known, the visible, and the predictable. Anything too difficult to measure is too often treated as if it were unreal. Further, management in many OEM businesses tends to assume that, whatever the OEM’s focus, their business and their peer OEMs share similar characteristics, organization structures, product development protocols and sales and marketing practices.

Even more misleading is the assumption that “business as usual” will prevail over a given planning period. Such assumptions leave little room for dynamic management (or creation) of change, the early identification of emerging markets or technical discontinuities, or the increased presence of unfamiliar competitors.

Based on our work with many OEMs, we believe that the impending shift in B2B platform models is likely to cause many of them considerable difficulty. Their traditional planning processes, and their linear view and built-in bias towards the established and predictable, will not prepare them well for the significant changes coming. ◆